2025 Gifting Rules

2025 Gifting Rules. Changes are coming to estate planning laws. With significant gift tax changes coming in 2025, the current federal gift tax exemption is set to be.

Gift Tax 2025 Limit Adam Vaughan, Since this amount is per person, married couples have a total gift tax limit of $38,000.

What Happens To Estate Tax in 2025?, For 2025, the annual gift tax exclusion rises to $19,000.

IRS Increases Gift and Estate Tax Thresholds for 2025, The unified estate and gift tax exclusion amount, $13,610,000 for gifts made and decedents dying.

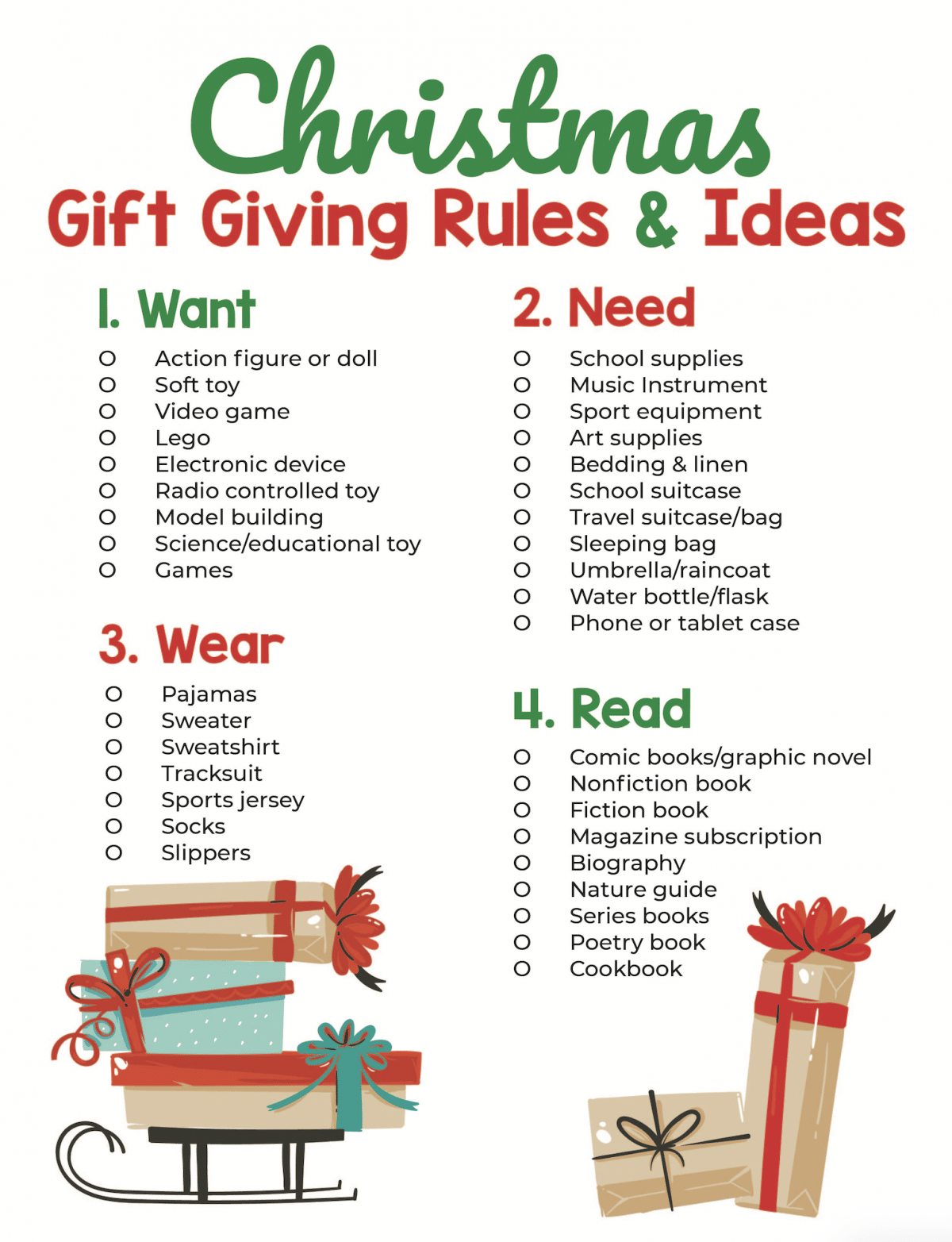

GIft Giving Rules for a Minimalist Christmas and Free Printable Gift Tags, The irs has announced that the annual gift tax exclusion is increasing in 2025 due to inflation.

Campaign 2025 The Impact of your Gift YouTube, The exclusion will be $19,000 per recipient for 2025.

Want need wear read christmas gift rules for families Artofit, With significant gift tax changes coming in 2025, the current federal gift tax exemption is set to be.

Premium Vector 3d gold year 2025 illustration vector eps with, The federal lifetime estate and gift tax exemption will sunset after 2025.

New Version Of Gifting Event Information! Rules And Timeline! YouTube, Spouses can elect to “split” gifts, which doubles the annual amount a married couple can give away in any.

2025 Corporate Gifting Trends Stay Ahead of the Game The Good Road, With significant gift tax changes coming in 2025, the current federal gift tax exemption is set to be.

Naspa Conference 2025 Anaheim. Individual member registration opens february 6, 2025, and is open to […]

2025 Calendar With Holidays Australia Excel. The calendar is printable and for free. Practical calendar […]